lincoln ne sales tax increase

Lincoln is the capital city of the us. You can print a 725 sales tax table here.

Gross Receipts Location Code And Tax Rate Map Governments

The current total local sales tax rate in Lincoln NE is 7250.

. The current state sales and. Automate sales tax compliance in the programs you use with Avalara AvaTax plugins. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public.

Lincoln voters passed the sales tax increase by a slim 650-vote margin and is set to go into effect Oct. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

There are sales tax rates for each state county and city here. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The December 2020 total local sales tax rate was also 7250.

In Lincoln another 15 percent or one and a half cents is added for a city sales tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will.

Many voters wonder how much it will cost people when they go to. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Lincoln Ne Sales Tax Rate Mei 15 2021.

Lincolns City sales and use tax rate increase. The Nebraska state sales and use tax rate is 55 055. The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1.

The group is asking the City Council to place on the April 9 primary. There is no applicable county tax or special tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

It was a close vote. The Nebraska state sales and use tax rate is 55 055. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

025 lower than the maximum sales tax in NE. The Nebraska state sales and use tax rate is 55 055. The Nebraska state sales and use tax rate is 55 055.

A coalition of community leaders today said a quarter-cent sale tax for streets is needed to keep Lincoln strong and growing. A yes vote was a vote in favor of authorizing the. It was approved.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. Lincoln selected two finalists to replace term-limited Mayor Chris Beutler and passed a 14-cent increase in city sales taxes to increase chuckhole repair and rehabilitation of streets in. This hotel is located in a city with a 175 city.

Lincoln To See New Sales Tax Revenue Starting October 1

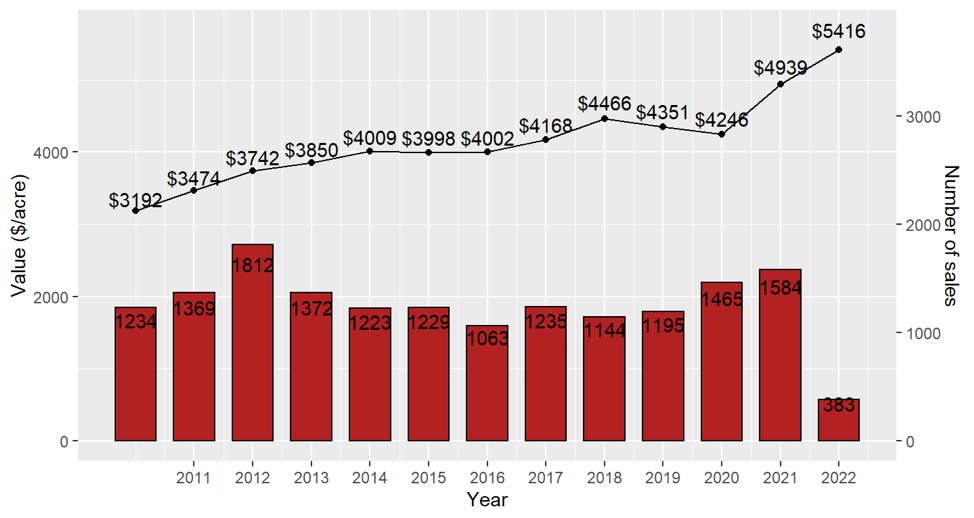

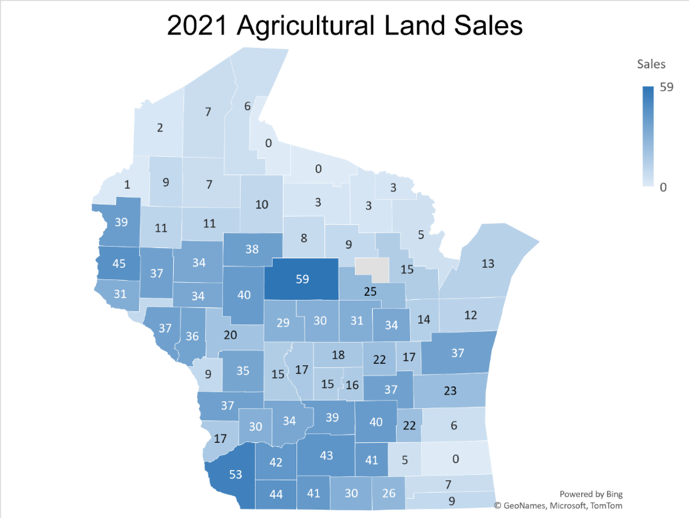

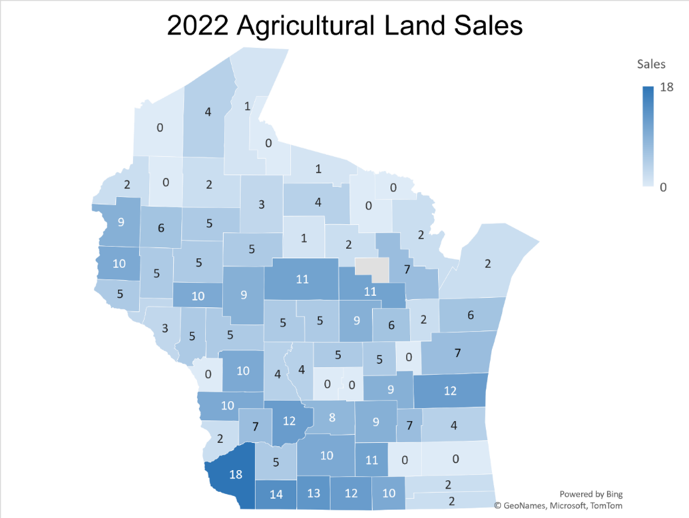

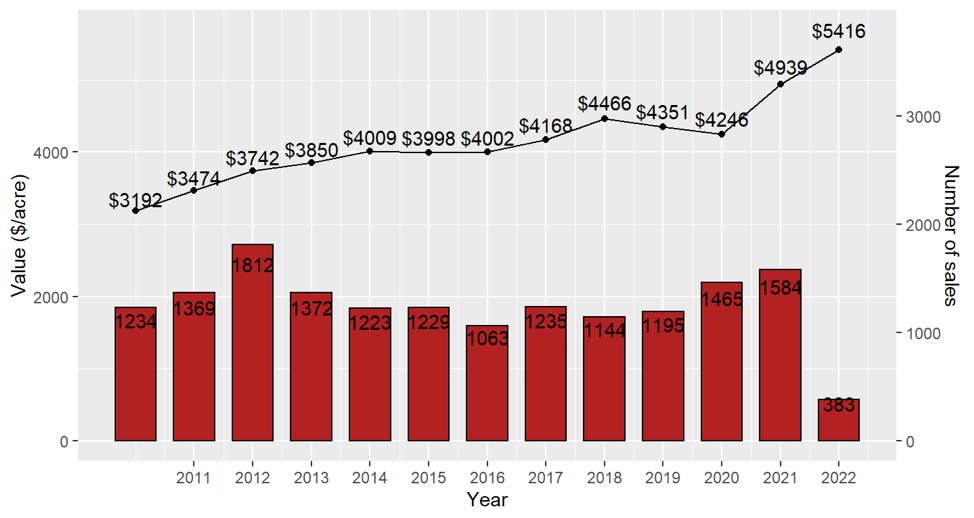

Wisconsin Agricultural Land Prices 2022 Farm Management

Wisconsin Agricultural Land Prices 2022 Farm Management

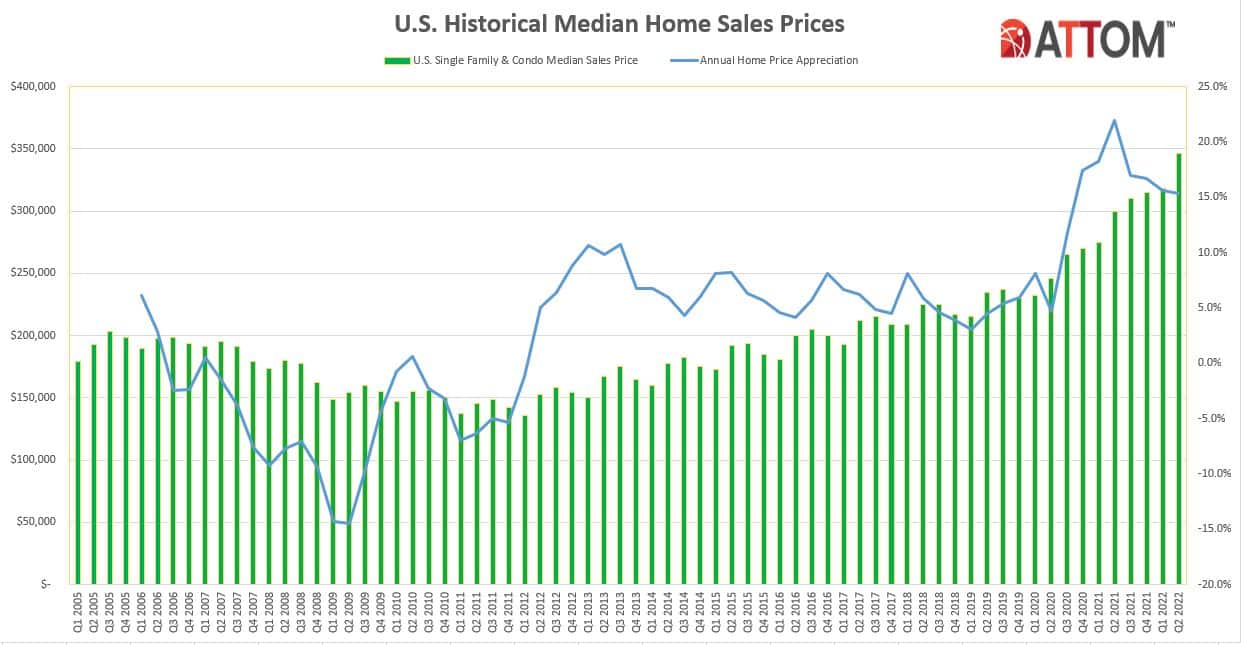

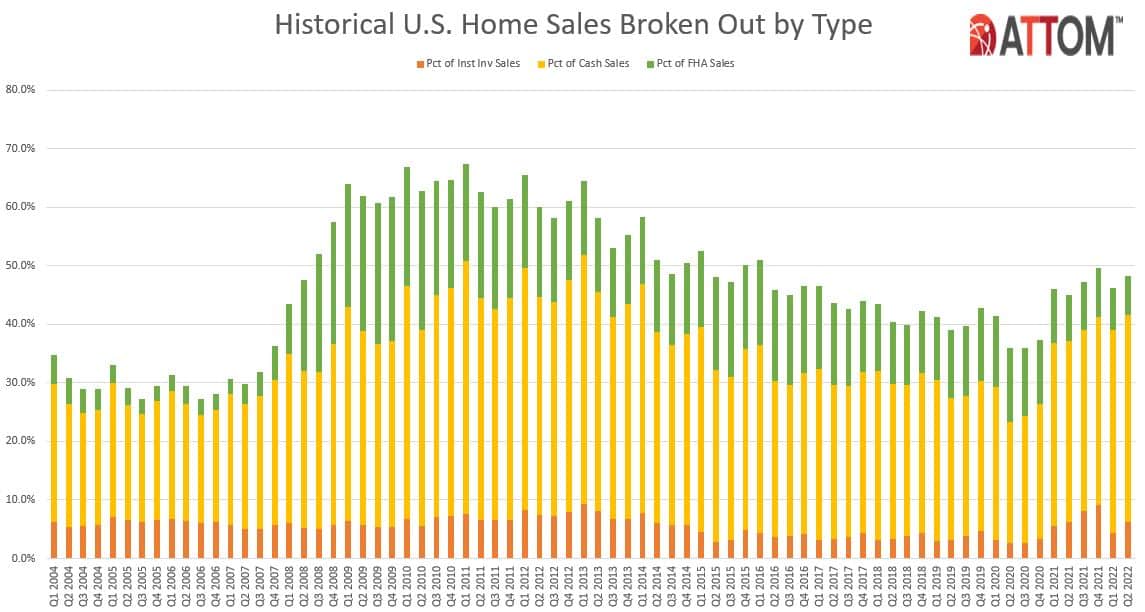

Home Seller Profits Surge Amid New Round Of Price Spikes Attom

Wisconsin Agricultural Land Prices 2022 Farm Management

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

Charles Apple Newspaper Design Layout Newspaper Design Newspaper Design Inspiration

Sales Engineer Salary Comparably

Current U S Drought Monitor Drought California Drought Map

You D Think 122 Million Would Buy You A Better Campaign Than This Infographics

How Does Sales Tax Work On Fitness Memberships Taxjar

Home Seller Profits Surge Amid New Round Of Price Spikes Attom

You D Think 122 Million Would Buy You A Better Campaign Than This Infographics

/cloudfront-us-east-1.images.arcpublishing.com/gray/WBWSIL6OJBFSRB2ZV6ZCZEIKQI.bmp)